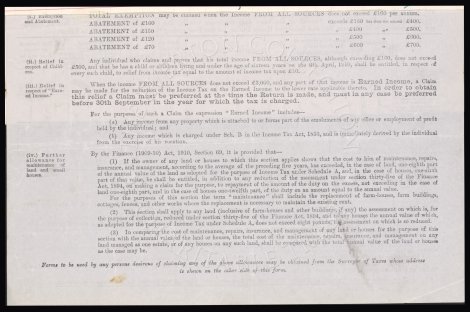

(i.) Exemption TOTAL EXEMPTION may be claimed when the Income FROM ALL SOURCES does not exceed £160 per annum. and Abatement. ABATEMENT of £160 " " " exceeds £160 but does not exceed £400. ABATEMENT of £150 " " " " £400 " £500. ABATEMENT of £120 " " " " £500 " £600. ABATEMENT of £70 " " " " £600 " £700. (ii.) Relief in Any individual who claims and proves that his total income FROM ALL SOURCES, although exceeding £160, does not exceed respect of Child- £500, and that he has a child or children living and under the age of sixteen years on the 6th April, 1910, shall be entitled, in respect of ren. every such child, to relief from income tax equal to the amount of income tax upon £10. (iii.) Relief in When the income FROM ALL SOURCES does not exceed £3,000, and any part of that income is Earned Income, a Claim respect of “Earn- may be made for the reduction of the Income Tax on the Earned Income to the lower rate applicable thereto. In order to obtain ed Income.” this relief a Claim must be preferred at the time the Return is made, and must in any case be preferred before 30th September in the year for which the tax is charged. For the purposes of such a Claim the expression "Earned Income" includes— (a) Any income from any property which is attached to or forms part of the emoluments of any office or employment of profit held by the individual; and (b) Any income which is charged under Sch. B in the income Tax Act, 1853, and is immediately derived by the individual from the exercise of his vocation. (iv.) Further By the Finance (1909-10) Act, 1910, Section 69, it is provided that— allowance for (1) If the owner of any land or houses to which this section applies shows that the cost to him of maintenance, repairs, maintenance of insurance, and management, according to the average of the preceding five years, has exceeded, in the case of land, one-eighth part land and small of the annual value of the land as adopted for the purpose of Income Tax under Schedule A, and, in the case of houses, one-sixth houses. part of that value, he shall be entitled, in addition to any reduction of the assessment under section thirty-five of the Finance Act, 1894, on making a claim for the purpose, to repayment of the amount of the duty on the excess, not exceeding in the case of land one-eighth part, and in the case of houses one-twelfth part, of the duty on an amount equal to the annual value. For the purposes of this section the term "maintenance" shall include the replacement of farm-houses, farm buildings, cottages, fences, and other works where the replacement is necessary to maintain the existing rent. (2) This section shall apply to any land (inclusive of farm-houses and other buildings, if any) the assessment on which is, for the purpose of collection, reduced under section thirty-five of the Finance Act, 1894, and to any houses the annual value of which, as adopted for the purpose of Income Tax under Schedule A, does not exceed eight pounds, the assessment on which is so reduced. (3) In comparing the cost of maintenance, repairs, insurance, and management of any land or houses for the purpose of this section with the annual value of the land or houses, the total cost of the maintenance, repairs, insurance, and management on any land managed as one estate, or of any houses on any such land, shall be compared with the total annual value of the land or houses as the case may be. Forms to be used by any persons desirous of claiming any of the above allowances may be obtained from the Surveyor of Taxes whose address is shown on the other side of this form.