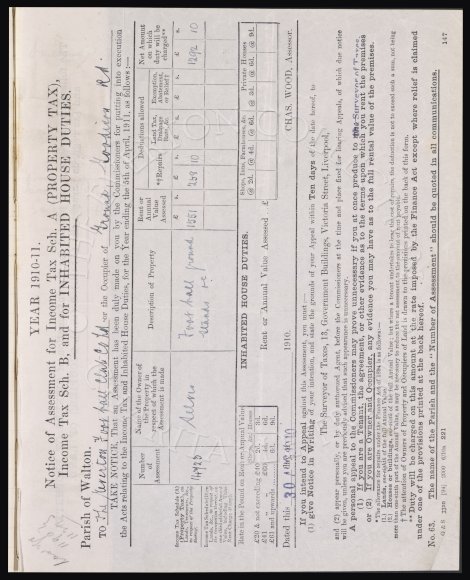

last yr YEAR. 1910-11.

1190 Notice of Assessment for Income Tax Sch. A (PROPERTY TAX),

1129 Income Tax Sch. B, and for INHABITED HOUSE DUTIES.

Parish of Walton.

To The Everton Football Club Co. Ltd .or the Occupier of Ground, Goodison Rd.

TAKE NOTICE, That an Assessment has been duly made on you by the Commissioners for putting into execution

the Acts relating to the Income Tax and Inhabited House Duties, for the Year ending the 5th of April, 1911, as follows:—

Number Name of the Owner of Rent or Deductions allowed Net Amount

of the property in Description of Property Annual on which

Assessment respect of which the Value Land Tax, Exemption, duty will be

Assessment is made Assessed *†Repairs Drainage Abatement, charged**

Rate, &c. or Relief†

£ s. £ s. £ s. £ s. £ s.

Income Tax Schedule (A)

(Property Tax), on 14723 Selves Foot ball ground 1551 258 10 1292 10

Lands, Tenements, &c., stands &c.

in respect of the Property

thereof.

Income Tax Schedule (B) on

Lands, &c., in respect of

the Occupation thereof, on

one-third of the full Annual

Value, including Tithe

Rent Charge (if any).

Rate in the Pound on Rent or Annual value INHABITED HOUSE DUTIES. Shops, Inns, Farmhouses, &c Private Houses

Shops. &c. Houses ® 2d. @ 4d. @6d. @3d. @ 6d. @ 9d.

£20 & not exceeding £40 2d. 3d.

£41 " " £60 4d. 6d. Rent or Annual Value Assessed .. £

£61 and upwards........ 6d. 9d.

Date this 30 AUG. 1910. CHAS. WOOD, Assessor.

If you intend to Appeal against this Assessment, you must:-

(1) give Notice in 'Writing of your intention, and state the grounds of your Appeal within Ten days of the date hereof, to

The Surveyor of Taxes, 13, Government Buildings, Victoria Street, Liverpool,

and (2) appear personally, or by duly authorized Agent, before the Commissioners at the time and place fixed for hearing Appeals, of which due notice

will be given, unless you are previously advised that such appearance is unnecessary.

A personal appeal to the Commissioners may prove unnecessary if you at once produce to me - the Surveyor of Taxes.

(1) If you are a Tenant, the agreement, or other evidence as to the terms upon which you rent the premises

or (2) If you are Owner and Occupier, any evidence you may have as to the full rental value of the premises.

The allowance for repairs under the Finance Act of 1894 is as follows:-

(1.) Lands, one-eighth of the full Annual Value.

(2.) Houses or buildings, one-sixth of the full Annual Value; but where a tenant undertakes to bear the cost of repairs, the deduction is not to exceed such a sum, not being

more than one-sixth part of the Annual Value, as may be necessary to reduce the net assessment to the amount of rent payable.

†The attention of Owners of Property and Occupiers of Land is drawn to the provisions printed on the back of this form.

** Duty will be charged on this amount at the rate imposed by the Finance Act except where relief is claimed

under one of the provisions printed at the back hereof.

No. 63. The name of the Parish and the "Number of Assessment" should be quoted in all communications.

G & S 3310 94 2000 6/10a 221 147