G & S 1858 229 6500 8/[] [300]

1.

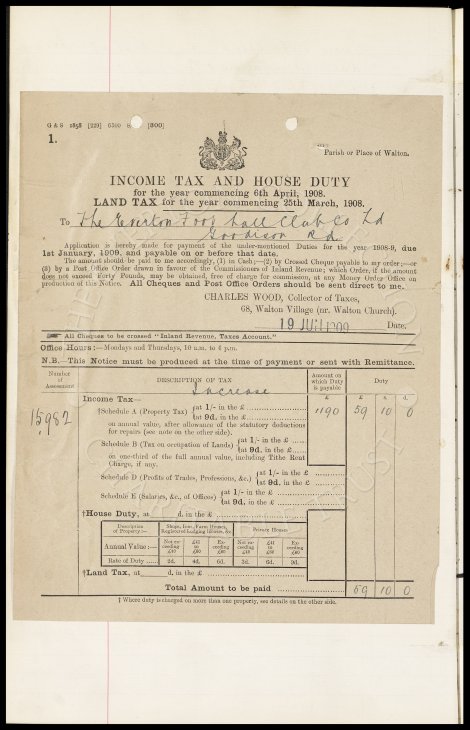

Parish or Place of Walton.

INCOME TAX AND HOUSE DUTY

for the year commencing 6th April, 1908.

LAND TAX for the year commencing 25th March, 1908.

To The Everton Football Club Co. Ltd.

Goodison Rd.

Application is hereby made for payment of the under-mentioned Duties for the year 1908-9, due

1st January, 1909, and payable on or before that date.

The amount should be paid to me accordingly, (1) in Cash;-(2) by Crossed Cheque payable to my order;-or

(3) by a Post Office Order drawn in favour of the Commissioners of Inland Revenue; which Order, if the amount

does not exceed Forty Pounds, may be obtained, free of charge for commission, at any Money Order Office on

production of this Notice. All Cheques and Post Office Orders should be sent direct to me.

CHARLES WOOD, Collector of Taxes,

68, Walton Village (nr. Walton Church).

19 JUN 1909 Date.

All Cheques to be crossed "Inland Revenue, Taxes Account."

Office Hours:- Mondays and Thursdays, 10 a.m. to 4 p.m.

N.B.-This Notice must be produced at the time of payment or sent with Remittance.

Number DESCRIPTION OF TAX Amount on

of which Duty Duty

Assessment Increase is payable

Income Tax- £ £ s. d.

†Schedule A (Property Tax) {at 1/- in the £.................. 1190 59 10 0

15982 {at 9d. in the £..................

on annual value, after allowance of the statutory deductions

for repairs (see note on the other side).

Schedule B (Tax on occupation of Lands){at 1/- in the £......

at 9d. in the £......

on one-third of the full annual value, including Tithe Rent

Charge, if any.

Schedule D (Profits of Trades, Professions, &c.) {at 1/- in the £......

{at 9d. in the £......

Schedule E (Salaries, &c., of Offices) {at 1/- in the £................

{at 9d. in the £................

†House Duty, at________d. in the £ .....................................

Description Shops, Inns, Farm Houses, Private Houses

of Property:- Registered Lodging Houses, &c.

Annual Value:- Not ex- £41 Ex- Not ex- £41 Ex-

ceeding to ceeding ceeding to ceeding

£40 £60 £60 £40 £60 £60

Rate of Duty... 2d. 4d. 6d. 3d. 6d. 9d.

†Land Tax, at_____d. in the £...........................................

Total Amount to be paid........................................ 59 10 0

† Where duty is charged on more than one property, see details on the other side.