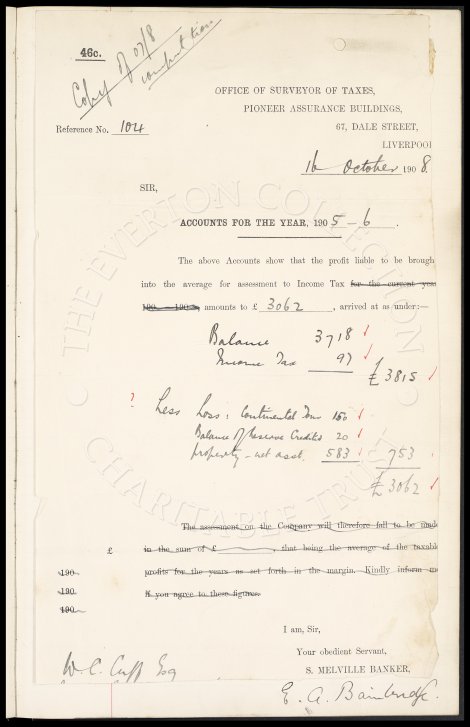

46c.

{Copy of 07/8

computation}

OFFICE OF SURVEYOR OF TAXES,

PIONEER ASSURANCE BUILDINGS,

Reference No. 104 67, DALE STREET,

LIVERPOOL

16 October 1908.

SIR,

ACCOUNTS FOR THE YEAR, 1905-6.

The above Accounts show that the profit liable to be brought

into the average for assessment to Income Tax for the current year

190_-190_ amounts to £3062, arrived at as under:-

Balance 3718

Income Tax 97

----- £3815

Less Loss: Continental Tour 150

Balance of Reserve Credited 20

Property - Net Asst. 583 753

----- -----

£3062

The assessment on the Company will therefore fall to be made

£ in the sum of £_______, that being the average of the taxable

190 profits for the years as set forth in the margin. Kindly inform me

190 if you agree to these figures.

190

I am, Sir,

Your obedient Servant,

W. C. Cuff Esq. S. MELVILLE BANKER,

E. A. Bainbridge