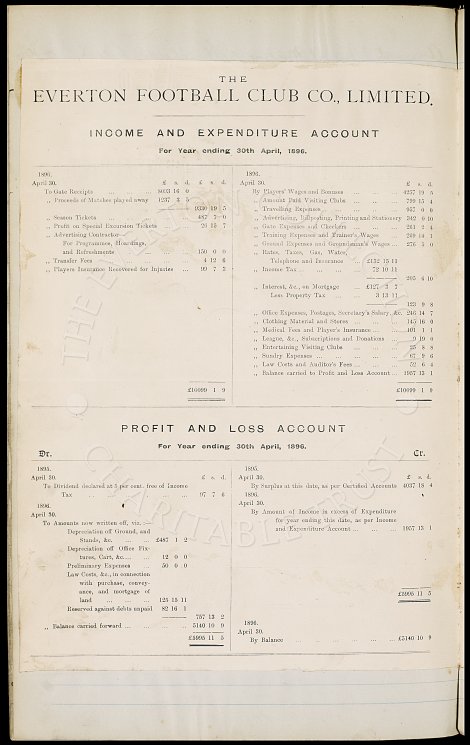

THE

EVERTON FOOTBALL CLUB CO., LIMITED

INCOME AND EXPENDITURE ACCOUNT

For Year ending 30th April, 1896.

1896. 1896.

April 30. £ s. d. £ s. d. April 30. £ s. d.

To Gate Receipts ... ... ... 8093 16 0 By Players' wages and Bonuses ... ... ... 4257 19 5

" Proceeds of Matches played away 1237 3 5 " Amount Paid Visiting Clubs ... ... ... 799 19 4

---- ---- 9330 19 5 " Travelling Expenses ... ... ... ... 957 0 0

" Season Tickets ... ... ... ... ... 487 7 0 " Advertising, Billposting, Printing and Stationery 342 0 10

" Profit on Special Excursion Tickets ... ... 26 15 7 " Gate Expenses and Checkers ... ... ... 261 2 4

" Advertising Contractor - " Training Expenses and Trainer's wages ... 269 14 1

For Programmes Hoardings, " Ground Expenses and Groundsman's Wages ... 276 5 0

and Refreshments ... ... ... ... 150 0 0 " Rates, Taxes, Gas, Water,

" Transfer Fee ... ... ... ... ... ... 4 12 6 Telephone and Insurance ... £132 15 11

" Players Insurance Recovered for Injuries ... 99 7 3 " Income Tax ... ... ... ... 72 10 11

------- --- 205 6 10

" Interest,&c., on Mortgage ... £127 3 7

Less Property Tax ... ... 3 13 11

---- --- 123 9 8

" Office Expenses, Postage, Secretary's Salary, &c. 246 14 7

" Clothing Material and Stores ... ... ... 145 16 0

" Medical Fees and Player's Insurance ... ... 101 1 1

" League, &c., Subscriptions and Donations ... 9 19 0

" Entertaining Visiting Clubs ... ... ... 25 8 8

" Sundry Expenses ... ... ... ... ... ... 67 9 6

" Law Costs and Auditor's Fee ... ... ... 52 6 4

" Balance Carried to Profit and Loss Account ... 1957 13 1

-------------- ---------------

£10099 1 9 £10099 1 9

-------------- ---------------

PROFIT AND LOSS ACCOUNT

For Year ending 30th April, 1896.

Dr. Cr.

1895. 1895.

April 30. £ s. d. April 30. £ s. d.

To Dividend declared at 5 percent. fee of Income By Surplus at this date, as per Certified Accounts 4037 18 4

Tax ... ... ... ... ... ... 97 7 6 1896

1896. April 30.

April 30. By Amount of Income in excess of Expenditure

To Amounts now written off, viz :- for year ending this date, as per Income

Depreciation off Ground, and and Expenditure Account ... ... ... 1957 13 1

Stands, &c. ... ... £487 1 2

Depreciation off Office Fix-

tures, Cart, &c. ... ... 12 0 0

Preliminary Expenses ... 50 0 0

Law Costs, &c., in connection

with purchase, convey-

ance, and mortgage of

land ... ... ... 125 15 11

Reserved against debts unpaid 82 16 1 ---------------

£5995 11 5

------------- 757 13 2 ---------------

" Balance carried forward ... ... ... 5140 10 9 1896.

--------------- April 30.

£5995 11 5 By Balance ... ... ... ... ... ... £5140 10 9

---------------

EVENTS

| 43 | Agreed that the Secretary arrange eggs, sherry and coffee for the players’ training in the morning |

| 73 | Agreed that the Club should pay the players’ expenses for joining the Liverpool gym at reduced rates |

| 91 | F. Geary appeared before the directors concerning his behaviour towards the spectators. |

| 113 | Agreed to give a match at Goodison Park for the benefit match for the unwaged. |

| 132 | Resolved that a letter be written to Porcupine saying the explanation re: stoppage of draws is not satisfactory. |

| 208 | Parry suspended. Notice of his suspension to be posted on in the dressing rooms. |

| 211 | Reserve Team to have a gold medal each. |

| 243 | Resolved Mr. Hinchcliffe be allowed to photograph team |

| 245 | Resolved on the purchase of 2 medals for Bell and Southworth |

| 286 | Resolved that Elliott be engaged as Assistant Trainer & Groundsman to play when required. |

| 295 | Resolved to give Stoke £20 for the transfer of Maxwell & to find him a place in a solicitors’ office. |

| 365 | Resolved to give 11 players medals for winning the Combination Championship |

| 444 | Resolved that the Ground Committee be authorised to have rooms covered over, urinals erected etc. |