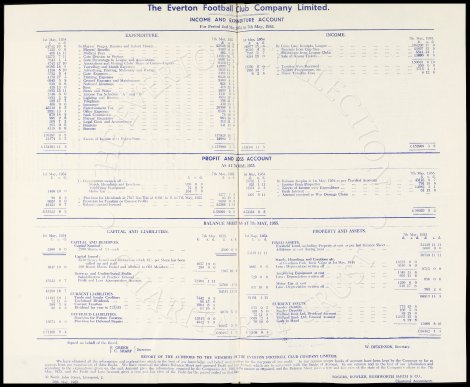

The Everton Football Club Company Limited.

INCOME AND EXPENDITURE ACCOUNT

For Period 2nd May, 1954, to 7th May, 1955.

EXPENDITURE INCOME

1st May,1954 7th May, 1955 1st May,1954 7th May,1955

£ s. d. £ s. d. £ s. d. £ s. d.

24742 10 0 To Players' Wages, Bonuses and Talent Money .... .... .... .... 25628 10 0 100677 15 6 By Gross Gate Receipts, League .... .... .... .... 104206 17 0

7325 0 0 " Players' Benefits .... .... .... .... .... .... .... .... 3500 0 0 20510 4 6 " Receipts from Cup Ties .... .... .... .... .... 23897 15 9

408 14 11 " Medical Fees .... .... .... .... .... .... .... .... .... 482 3 11 7587 1 7 " Percentage from League Clubs.... .... .... .... 8844 14 1

12275 7 11 " Gate Division to Visitors.... .... .... .... .... .... .... 13983 10 2 8244 15 0 " Sale of Season Tickets ... .... .... .... .... 13690 0 0

7543 1 4 " Gate Percentage to League and Associations .... .... .... .... 8997 14 5 ____________

4743 17 10 " Associations and Visiting Clubs'Share of Gates-Cupties .... 6310 12 7 150639 6 10

10595 18 8 " Travelling and Match Expenses .... .... .... .... .... .... 14954 7 6 12550 0 0 " Transfer Fees Received ... .... .... .... .... 550 0 0

1136 5 10 " Advertising, Printing, Stationery and Postage . .... .... .... 1656 12 1 1985 12 7 " Sublets, Programmes,etc... .... .... .... .... 1715 4 4

3732 0 4 " Gate Expenses .... .... .... ... .... .... .... .... .... 4466 15 9 6 2 6 " Share Transfer Fees ... .... .... .... .... 4 12 6

4178 17 2 " Training Expenses .... .... ... .... .... .... .... .... 6136 16 9

6945 5 9 " Ground Expenses and Maintenance ... .... .... .... .... .... 8300 4 4

818 0 6 " National Insurance .... .... ... .... .... .... .... .... 826 8 4

418 13 0 " Rent .... .... ... .... .... ... .... .... .... .... .... 418 13 0

3955 15 11 " Rates and Water... .... .... ... .... .... .... .... .... 3950 6 9

1340 3 0 " Income Tax Schedule " A " and " B " .... .... .... .... .... 1341 0 0

1893 2 9 " Lighting and Heating .... .... ... .... .... .... .... .... 1854 16 2

385 17 7 " Telephone .... ... .... .... ... .... .... .... .... .... 396 11 1

409 9 0 " Insurance .... ... .... .... ... .... .... .... .... .... 439 13 1

25318 6 5 " Entertainment Tax... .... .... ... .... .... .... .... .... 26398 6 5

5551 13 1 " Office Expenses ... .... .... ... .... .... .... .... .... 6198 6 8

679 14 9 " Bank Commission ... .... .... ... .... .... .... .... .... 76 10 9

996 0 6 " Players' Requisites .... .... ... .... .... .... .... .... 963 14 8

209 7 2 " Legal Costs and Accountancy.... ... .... .... .... .... .... 313 11 2

265 0 0 " Pensions .... .... .... .... ... .... .... .... .... .... 331 13 0

4319 6 0 " Bonuses .... .... .... .... ... .... .... .... -

___________

130187 9 5 137926 18 7

21374 2 3 " Excess of Income over Expenditure.. .... .... .... 14982 5 1

____________ ____________ _____________ ____________

£151561 11 8 £152909 3 8 £151561 11 8 £152909 3 8

____________ ____________ _____________ ____________

PROFIT AND LOSS ACCOUNT

AS AT 7TH MAY, 1955.

1st May, 1954 7th May, 1955 1st May, 1954 7th May, 1955

£ s. d. £ s. d. £ s. d. £ s. d. £ s. d.

To Depreciation written off:- 27732 1 2 By Balance Surplus at 1st May, 1954 as per Certified Accounts... 43123 9 7

Stands, Hoardings and Erections... ... ... ... 970 0 0 910 1 11 " Income from Properties ... ... ... ... ... ... .. ... 791 19 0

Amplifying Equipment ... ... .... ... ... ... 73 0 0 21374 2 3 " Excess of Income over Expenditure .. ... ... ... .. ... 14982 5 1

1469 10 0 Motor Car ... ... ... ... .... ... ... ... 234 7 6 - " Bank Interest .... ... ... ... ... ... ... ... ... 31 15 6

___________ 1277 7 6 1307 0 11 " Amount received re War Damage Claim ... ... ... ... ... -

80 6 8 " Provision for Dividends at 7½% less Tax at 8/6d.in £ to 7th May, 1955 83 19 9

6650 0 0 " Provision for Taxation on Current Profits... ... ... 5000 0 0

43123 9 7 " Balance carried forward ... .... ... ... ... ... 52568 1 11

______________ ____________ _____________ _____________

£51323 6 3 £58929 9 2 £51323 6 3 £58929 9 2

______________ ____________ _____________ _____________

BALANCE SHEET AS AT 7th MAY 1955.

CAPITAL AND LIABILITIES PROPERTY AND ASSETS.

1st May, 1954 7th May, 1955 1st May, 1954 7th May, 1955

£ s. d. £ s. d. £ s. d. £ s. d. £ s. d. £ s. d.

CAPITAL AND RESERVES. FIXED ASSETS.

Capital Nominal: Freehold Land, including Property at cost as per last Balance Sheet 53139 11 11

2500 0 0 2500 Shares of £1 each ... ... ... ... ... ... ... 2500 0 0 Additions at cost during year .... .... .... .... .... .... .. 3600 0 0

__________ _________ 53139 11 11 ____________

Capital Issued : 56739 11 11

2210 Shares Issued and Allotted on which 15/- per Share has been Stands, Hoardings and Erections etc.

called up and paid ... ... ... ... ... ... 1657 10 0 at Goodison Park, Book Value at 1st May, 1948.. .... .... .... .. 18225 0 0

1947 10 0 290 Bonus Shares Issued and Allotted to Old Members 290 0 0

9685 0 0 Less : Depreciation written off .... ... ... .. .... ... .... .. 9510 0 0

__________ 1947 10 0 __________ 8715 0 0

Reserves and Undistributed Profits. Amplifying Equipment at cost .... ... ... .. .... .. .... .. 1349 11 6

Rehabilitation of Practice Ground .... .... .... 729 0 0 Less : Depreciation written off . ... ... .. .... .. .... .. 693 11 6

43333 6 7 Profit and Loss Appropriation Account 52568 1 11 - __________ 656 0 0

__________ 52568 1 11 Motor Car at cost ... ... .... ... ... .. .... .. .... .. 1250 0 0

___________ _____________ 937 10 0 Less . Depreciation written off .. ... ... .. ... .. .... .. 546 17 6

45280 16 7 54515 11 11 __________ 703 2 6

CURRENT LIABILITIES ____________ ____________

11492 10 1 Trade and Sundry Creditors ... .... ... ... 7342 4 3 64491 1 11 66813 14 5

72 11 8 Unclaimed Dividends .... .... ... ... 88 15 0

509 5 8 Current Taxation ... ... ... .... ... ... 1564 6 8 CURRENT ASSETS.

80 6 8 Dividend for year to 7/5/55.. .... ... ... 83 19 9 655 9 5 Sundry Debtors.... .... .... .... .. ... .. ... .. ... ... .. . 773 15 8

__________ 9079 5 8 160 5 0 Sundry Deposits... .... .... .... .. ... .. ... .. ... ... .. . 160 5 0

DEFERRED LIABILITIES. 72 11 8 Midland Bank Ltd. Dividend Account.. .. ... .. ... .. ... ... .. . 88 15 0

Provision for Future Taxation.. .... ... ... 12045 0 0 5658 2 4 Midland Bank Ltd. General Account .. .. ... .. ... .. ... ... .. 12635 15 9

13672 9 8 Provision for Deferred Repairs .... ... ... 4842 3 8 70 10 0 Cash in Hand .... .... .. ... .. ... .. ... ... .. 9 15 5

___________ 16887 3 8 ____________ 13668 6 10

______________ _____________ ____________ _____________

£71108 0 4 £80482 1 3 £71108 0 4 £80482 1 3

______________ _____________ ____________ _____________

Signed on behalf of the Board, W. DICKINSON, Secretary,

E. GREEN

J. C. SHARP Directors.

REPORT OF THE AUDITORS TO THE MEMBERS OF THE EVERTON FOOTBALL CLUB COMPANY LIMITED.

We have obtained all the information and explanations which to the best of our knowledge and belief were necessary for the purposes of our audit. In our opinion proper books of account have been kept by the Company so far as

appears from our examination of these Books. We have examined the above Balance Sheet and annexed Profit and Loss Account, which are in agreement with the Books of Account. In our opinion and to the best of our information and

according to the explanations given us, the said Account gives the information required by the Companies Act, 1948, in the manner so required, and the Balance Sheet gives a true and fair view of the state of the Company's affairs at the 7th

May, 1955, and the Profit and Loss Account gives a true and fair view of the Profit for the period ended on that date.

30 North John Street, Liverpool, 2. ROGERS, BOWLER, RUSHWORTH SMITH & CO.,

26th May, 1955. Chartered Accountants,