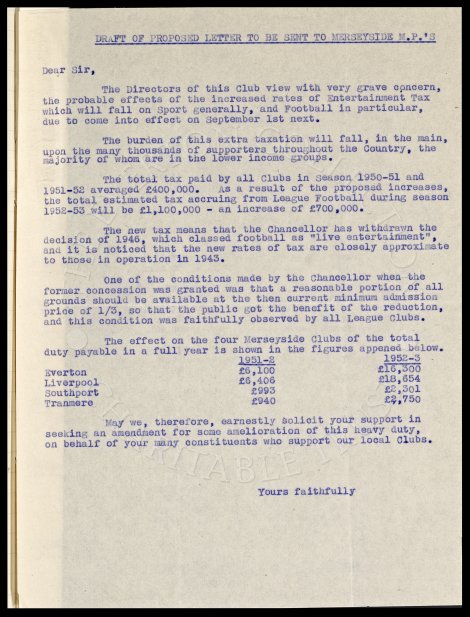

DRAFT OF PROPOSED LETTER TO BE SENT TO MERSEYSIDE M.P.'S Dear Sir, The Directors of this Club view with very grave concern, the probable effects of the increased rates of Entertainment Tax which will fall on Sport generally, and Football in particular, due to come into effect on September 1st next. The burden of this extra taxation will fall, in the main, upon the many thousands of supporters throughout the Country, the majority of whom are in the lower income groups. The total tax paid by all Clubs in Season 1950-51 and 1951-52 averaged £400,000. As a result of the proposed increases, the total estimated tax accruing from League Football during season 1952-53 will be £1,100,000 - an increase of £700,000. The new tax means that the Chancellor has withdrawn the decision of 1946, which classed football as "live entertainment", and it is noticed that the new rates of tax are closely approximate to those in operation in 1943. One of the conditions made by the Chancellor when the former concession was granted was that a reasonable portion of all grounds should be available at the then current minimum admission price of 1/3, so that the public got the benefit of the reduction, and this condition was faithfully observed by all League Clubs. The effect on the four Merseyside Clubs of the total duty payable in a full year is shown in the figures appened below. 1951-2 1952-3 Everton £6,100 £16,300 Liverpool £6,406 £18,654 Southport £993 £2,301 Tranmere £940 £2,750 May we, therefore, earnestly solicit your support in seeking an amendment for some amelioration of this heavy duty, on behalf of your many constituents who support our local Clubs. Yours faithfully