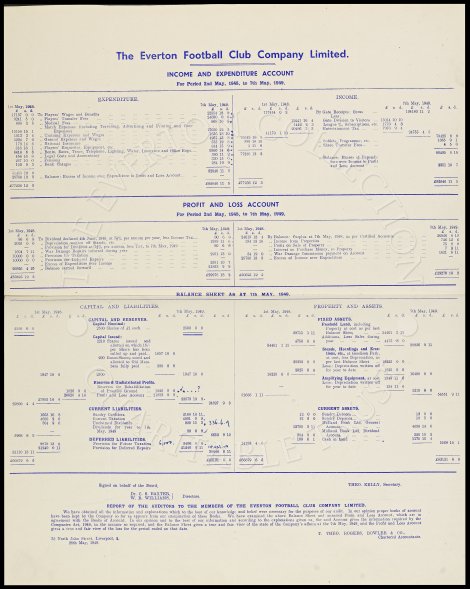

The Everton Football Club Company Limited.

INCOME AND EXPENDITURE ACCOUNT,

For Period 2nd May, 1948, to 7th May, 1949.

EXPENDITURE INCOME

1st May, 1948. 7th May, 1949 1st May, 1948 7th May, 1949.

£ s. d. £ s. d. £ s. d. £ s. d. £ s. d. £ s. d. £ s. d. £ s. d.

17137 0 0 To Players' Wages & Benefits ... ... ... ... ... ... ... ... ... ... 22554 18 0 117414 0 3 By Gate Receipts: Gross ... ... 104180 11 2

3241 5 0 " Players' Transfer Fees ... ... .. ... ... ... ... ... ... ... ... 24050 0 0 Less:

608 2 5 " Medical Fees ... ... ... ... .. ... ... ... ... ... ... ... ... 868 10 8 19241 16 4 Gate Division to Visitors 15014 10 10

" Match Expenses (including Travelling, Advertising and Printing Gate 1442 2 3 League %, Subscriptions, etc. 1770 4 3

15150 15 1 Expenses) ... ... ... ... ... ... ... ... ... ... ... ... 17030 12 5 20486 3 3 Entertainment Tax ... ... 7970 9 4

1813 3 6 " Training Expenses and Wages ... ... ... ... ... ... ... ... ... ... 1656 18 10 41170 1 10 ___________ _____________ 24755 4 5

5224 7 0 " Ground Expenses and Wages ... ... ... ... ... ... ... ... ... ... 4957 15 8 76243 18 5 _____________ _____________ 79425 6 9

173 16 6 " National Insurance ... ... ... ... ... ... ... ... ... ... ... ... 555 19 8 990 18 10 " Sublets, Programme, etc. ... 1065 9 1

816 16 1 " Players' Requisites, Equipment, etc. ... ... ... ... ... ... ... 814 15 9 1 15 0 " Share Transfer Fees ... ... 4 5 0

6416 6 6 " Rent,Rates,Taxes,Telephone,Lighting, Water,Insurance,and office Exps 9360 14 6 ____________ ___________

456 16 8 " Legal Costs and Accountancy ... ... ... ... ... ... ... ... ... ... 380 11 2 77236 12 3 80495 0 10

267 10 0 " Pensions ... ... ... ... .. ... ... ... ... ... ... ... ... ... 330 15 0 " Balance: Excess of Expendi-

150 0 3 " Bank Charges ... ... ... .. ... ... ... ... ... ... ... ... ... 284 19 9 ture over Income to profit

___________ ___________ and Loss Account ... 2351 10 7

51455 19 0 82846 11 5

25780 13 3 " Balance: Excess of Income over Expenditure to profit and Loss Account __

___________ ____________ ____________ ____________

£77236 12 3 £82846 11 5 £77236 12 3 £82846 11 5

PROFIT AND LOSS ACCOUNT,

For Period 2nd May, 1948, to 7th May, 1949.

1st May, 1948. 7th May, 1949 1st May, 1948. 7th May, 1949

£ s. d. £ s. d. £ s. d. £ s. d.

80 6 8 To Dividend declared 4th June, 1948, at 7½% per annum, per year, less Income Tax ... 80 6 8 24615 13 4 By Balance Surplus at 7th May, 1948, as per Certified Accounts ... ... ... ... ... ... ... 26826 4 10

2025 0 0 " Depreciation Written off stands, etc. ... ... ... ... ... ... ... ... ... ... .. 1959 11 6 194 13 10 " Income from properties ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... 746 12 6

_ " Provision for Dividend at 7½% per annum, less Tax, to 7th May, 1949 ... ... ... 80 6 8 __ " Profit on Sale of Property ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... 75 8 0

1694 7 11 " War Damage Repairs incurred during year ... ... ... ... ... ... ... ... ... . __ __ " Interest on Purchase Money, re Property ... ... ... ... ... ... ... ... ... ... ... ... 7 3 11

10000 0 0 " Provision for Taxation ... ... ... ... ... ... ... ... ... ... ... ... ... ... 2951 13 0 34 19 0 " War Damage Commission payment on Account... ... ... ... ... ... ... ... ... ... ... ... 1621 8 11

10000 0 0 " Provision for Deferred Repairs ... ... ... ... ... ... ... ... ... ... ... ... __ 25780 13 3 " Excess of Income over Expenditure ... ... ... ... ... ... ... ... ... ... ... ... ... __

___ " Excess of Expenditure over Income ... ... ... ... ... ... ... ... ... ... ... 2351 10 7

26826 4 10 " Balance carried forward ... ... ... ... ... ... ... ... ... ... ... ... ... ... 21853 9 9

____________ ___________ _______________ ____________

£50625 19 5 £29276 18 2 £50625 19 5 £29276 18 2

BALANCE SHEET AS AT 7th MAY, 1949.

CAPITAL AND LIABILITIES. PROPERTY AND ASSETS.

1st May, 1948. 7th May, 1949 1st May, 1948 7th May, 1949

£ s. d. £ s. d. £ s. d. £ s. d. £ s. d. £ s. d. £ s. d. £ s. d. £ s. d. £ s. d. £ s. d. £ s. d.

CAPITAL AND RESERVES. FIXED ASSETS.

Capital Nominal: Freehold Lane, including

2500 0 0 2500 Shares of £1 each ............ 2500 0 0 Property at cost as per last

__________ Capital Issued: __________ 29711 1 11 Balance Sheet ... ... 34461 1 11

Additions, Less Sales during

2210 Shares issued and 4750 0 0 year ... ... ... ... ... 4475 8 0

allotted on which 15/- 34461 1 11 _____________ ___________ 38936 9 11

per Share has been Stands, Hoardings and Erec-

called up and paid... 1657 10 0 tions, etc., at Goodison park,

290 Bonus Shares issued and at cost, less Depreciation, as

allotted to Old Mem- 20250 0 0 per last Balance Sheet 18225 0 0

bers fully paid ... 290 0 0 Less: Depreciation written off

2025 0 0 for year to date ... ... ... 1825 0 0

______ ___________ 1947 10 0 18225 0 0 _____________ ____________ 16400 0 0

1947 10 0 2500 Amplifying Equipment, at cost 1349 11 6

Reserves & Undistributed Profits. Less: Depreciation written off

Reserves for Rehabilitation ___ for year to date ... ... ... 134 11 6

1026 9 6 of Practice Ground ... ... 1026 9 6 _____________ 1215 0 0

26826 4 10 Profit and Loss Account... . 21853 9 9 52686 1 11 _____________ __________ 56551 9 11

27852 14 4 ______________ 22879 19 3

29800 4 4 ______________ ___________ 24827 9 3

CURRENT LIABILITIES. CURRENT ASSETS.

1663 16 8 Sundry Creditors ... ... 2160 18 11 12 0 0 Sundry Debtors ... ... ... 12 0 0

4000 2 0 Current Taxation ... ... 4091 9 0 12 5 0 Sundry Deposits .. ... ... 10 5 0

304 9 6 Unclaimed Dividends ... 320 15 3 {336 6 9} Midland Bank Ltd. General .

Dividends for year to 7th 13755 3 11 Account ... ... ... ... ... 4050 14 6

__ May, 1949 ... ... ... 80 6 8 Midland Bank Ltd. Dividend

5968 8 2 ______________ ___________ 6653 9 10 304 9 6 Account ... ... ... ... ... 320 15 3

DEFERRED LIABILITIES. 109 6 1 Cash in hand .. ... ... ... 1175 15 4

9870 13 0 Provision for future Taxation {6000} 9400 0 0{14425 0 0} 14193 4 6 ______________ ___________ 5569 10 1

21240 0 11 Provision for Deferred Repairs 21240 0 11

31110 13 11 _____________ _____________ 30640 0 11

___________ ____________ _____________ ____________

£668796 5 £62121 0 0 £66879 6 5 £62121 0 0

Signed on behalf of the Board, THEO. KELLY, Secretary.

Dr. C. S. BAXTER,}

W. R. WILLIAMS, } Directors.

REPORT OF THE AUDITORS TO THE MEMBERS OF THE EVERTON FOOTBALL CLUB COMPANY LIMITED.

We have obtained all the information and explanations which to the best of our knowledge and belief were necessary for the purposes of our audit. In our opinion proper books of account

have been kept by the Company so far as appears from our examination of these Books. We have examined the above Balance Sheet and annexed Profit and Loss Account, which are in

agreement with the Books of Account. In our opinion and to the best of our information and according to the explanations given us, the said Account gives the information required by the

Companies Act, 1948, in the manner so required, and the Balance Sheet gives a true and fair view of the state of the Company's affairs at the 7th May, 1949, and the Profit and Loss Account

gives a true and fair view of the loss for the period ended on that date.

T. THEO. ROGERS, BOWLER & CO.,

30 North John Street, Liverpool, 2. Chartered Accountants.

28th May, 1949.