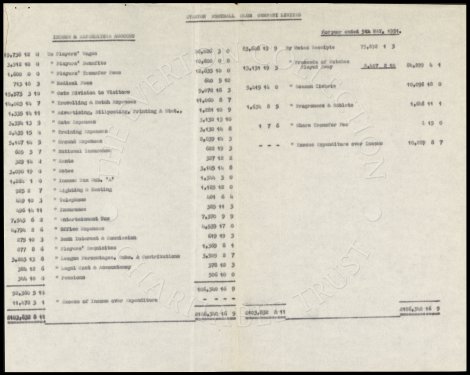

EVERTON FOOTBALL CLUB COMPANY LIMITED INCOME & EXPENDITURE ACCOUNT for year ended 5th May, 1951 19,738 12 0 To Players’ Wages 20,026 3 0 83,648 19 9 By Gates Receipts 75,892 1 3 3,912 10 0 " Players’ Benefit 10,800 0 0 " Proceeds of Matches 1,600 0 0 " Players’ Transfer Fees 12,635 10 0 13,131 19 3 Played Away 8,407 2 10 84,299 4 1 713 18 3 " Medical Fees 640 5 10 _____________ 15,573 3 10 " Gate Division to Visitors 9,072 18 3 5,415 14 0 " Season Tickets 10,098 18 0 14,003 14 7 " Travelling & Match Expenses 11,060 8 7 1,335 14 11 " Advertising, Billposting, Printing & Stat., 1,281 10 9 1,634 8 5 " Programmes & Sublets 1,648 11 1 3,354 13 5 " Gate Expenses 3,130 13 10 2,435 15 4 " Training Expenses 3,130 14 8 1 7 6 " Share Transfer Fee 4 15 0 5,107 14 5 " Ground Expenses 8,839 14 3 605 3 7 " National Insurance 622 19 3 - - - " Excess Expenditure over Income 10,289 8 7 329 14 2 " Rents 327 12 2 3,090 19 0 " Rates 3,145 14 8 7,264 1 0 " Income Tax Sch. 'A' 1,344 3 0 925 2 7 " Lighting & Heating 1,125 12 0 449 10 3 " Telephone 481 6 4 496 14 11 " Insurance 385 11 3 7,543 6 2 " Entertainment Tax 7,370 9 9 4,794 2 6 " Office Expenses 4,539 17 0 275 10 3 " Bank Interest & Commission 619 19 3 877 8 6 " Players' Requisites 1,369 8 1 3,203 13 8 " League Percentages, subs. & contributions 3,505 2 7 384 12 6 " Legal Cost & Accountancy 378 12 3 344 10 0 " Pensions 506 10 0 ___________________ 92,360 5 10 106,340 16 9 11,472 3 1 " Excess of Income over Expenditure -- -- -- -- ___________________ 103,832 8 11 £106,340 16 9 £103,832 8 11 £106,340 16 9 __________________ _________________ ______________ ______________