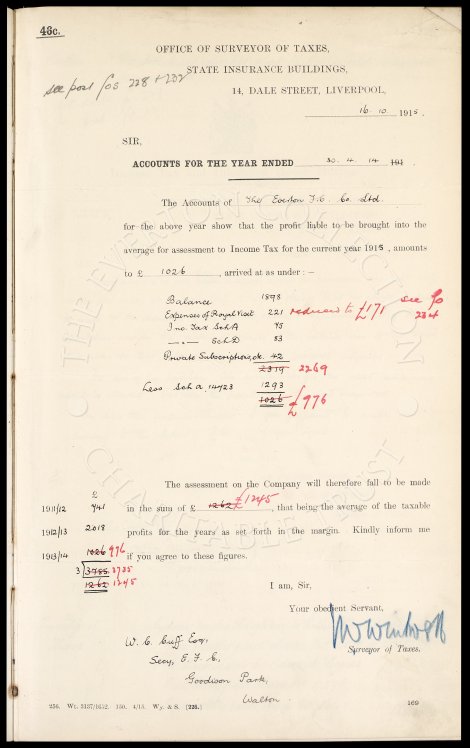

46c. OFFICE OF SURVEYOR OF TAXES, STATE INSURANCE BUILDINGS, see post fos. 228 & 232 14, DALE STREET, LIVERPOOL, 16.10.1915. SIR, ACCOUNTS FOR THE YEAR ENDED 30.4.14. The Accounts of The Everton F.C. Co. Ltd. for the above year show that the profit liable to be brought into the average for assessment to Income Tax for the current year 1915, amounts to £1026, arrived at as under :- Balance 1898 Expenses of Royal Visit 221 reduced to £171 see fo. Inc. Tax Sch. A 75 234 --.-- Sch. D 83 Private Subscription, etc. 42 ------ 2319 2269 Less Sch. A 14723 1293 ------ 1026 £976 The assessment on the Company will therefore fall to be made £ 1911/12 741 in the sum of £1262 £1245, that being the average of the taxable 1912/13 2018 profits for the years as set forth in the margin. Kindly inform me 1913/14 1026 976 ---- if you agree to these figures. 3 |3785 3735 ---- 1262 1245 I am, Sir, Your obedient Servant, W. C. Cuff Esq., M. Whitwell Secy. E. F. C., Surveyor of Taxes, Goodison Park, Walton. 256. Wt. 3137/1652. 150. 4/15 Wy. & S. 226. 169