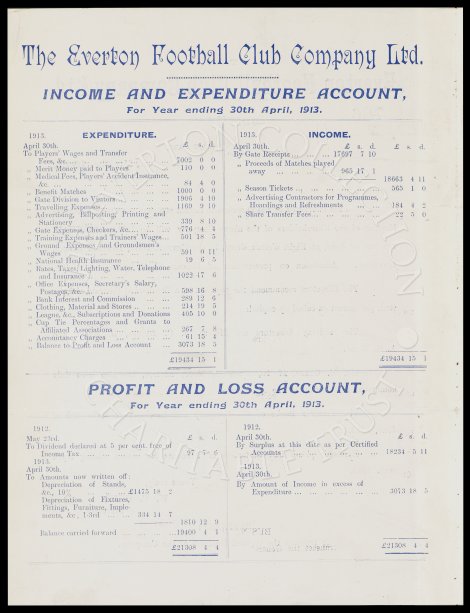

The Everton Football Club Company Ltd. ............ INCOME AND EXPENDITURE ACCOUNT, For Year ending 30th April, 1913. _____________________________________________________________________________________________________________________________________________ 1913. EXPENDITURE. 1913. INCOME. April 30th. £ s. d. April 30th. £ s. d. £ s. d. To Players' Wages and Transfer By Gate Receipts... ... ... 17697 7 10 Fees, &c. ... ... ... ... 7002 0 0 " Proceeds of Matches played " Merit Money paid to Players 110 0 0 away ... ... ... 965 17 1 " Medical Fees, Players' Accident Insurance, ____________ 18663 4 11 &c. ... ... ... ... ... 84 4 0 " Benefit Matches ... ... ... 1000 0 0 " Season Tickets ... ... ... ... 565 1 0 " Gate Division to Visitors ... ... 1906 4 10 " Advertising Contractors for Programmes, " Travelling Expenses ... ... ... 1169 9 10 Hoardings and Refreshments ... ... 184 4 2 " Advertising, Billposting, Printing and " Share Transfer Fees ... ... ... ... 22 5 0 Stationery ... ... ... ... 339 8 10 " Gate Expenses, Checkers, &c. ... ... 776 4 4 " Training Expenses and Trainers' Wages ... 501 18 5 " Ground Expenses and Groundsmen's Wages ... ... ... ... 591 0 11 " National Health Insurance ... ... 19 6 5 " Rates, Taxes, Lighting, Water, Telephone and Insurance ... ... ... ... 1022 17 6 " Office Expenses, Secretary's Salary, Postages, &c. ... ... ... ... 598 16 8 " Bank Interest and Commission ... ... 289 12 6 " Clothing, Material and Stores ... ... 214 19 5 " League, &c., Subscriptions and Donations 405 10 0 " Cup Tie Percentages and Grants to Affiliated Associations ... ... 267 7 8 " Accountancy Charges ... ... ... 61 15 4 " Balance to Profit and Loss Account ... 3073 18 5 ____________ ____________ £19434 15 1 £19434 15 1 ____________ ____________ _____________________________________________________________________________________________________________________________________________ PROFIT AND LOSS ACCOUNT, For Year ending 30th April, 1913. _____________________________________________________________________________________________________________________________________________ 1912. 1912. May 23rd. £ s. d. April 30th. £ s. d. To Dividend declared at 5 per cent, free of By Surplus at this date as per Certified Income Tax ... ... ... ... 97 7 6 Accounts ... ... ... ... ... 18234 5 11 1913. April 30th. 1913. To Amounts now written off: April 30th. Depreciation of Stands, By Amount of Income in excess of &c., 10% ... ... £1475 18 2 Expenditure ... ... ... ... ... ... 3073 18 5 Depreciation of Fixtures, Fittings, Furniture, Imple- ments, &c., 1-3rd ... 334 14 7 ____________ 1810 12 9 Balance carried forward ... ... 19400 4 1 ____________ ____________ £21308 4 4 £21308 4 4 ____________ ____________ _____________________________________________________________________________________________________________________________________________